Jupiter Money- Acquisition Project

Does managing your finances still feel like a hassle 🤯? Say hello to your new best friend, Jupiter.money, a smart neobank that makes banking a breeze!

Picture having a high-interest savings account, intuitive expense tracking, and tailored savings goals—all in one app. With Jupiter, you can effortlessly grow your savings without the frustration of hidden fees or outdated banking processes. If you’re seeking simplicity, transparency, and a banking experience that fits your fast-paced lifestyle, Jupiter is here for you! 🚀✨

👀 About Jupiter

https://www.youtube.com/watch?v=2zZU8y4cV0

Jupiter is a leading neobank in India, designed to simplify financial management for users. It provides a range of services, including attractive savings accounts, intuitive tools for tracking spending, and customizable savings plans. Unlike conventional banks, Jupiter focuses on transparency and ease of use, ensuring that users can navigate their finances without the frustrations of hidden charges or lengthy processes.

Vision :

Rrevolutionize personal finance management by providing a seamless, transparent, and user-centric digital banking experience.

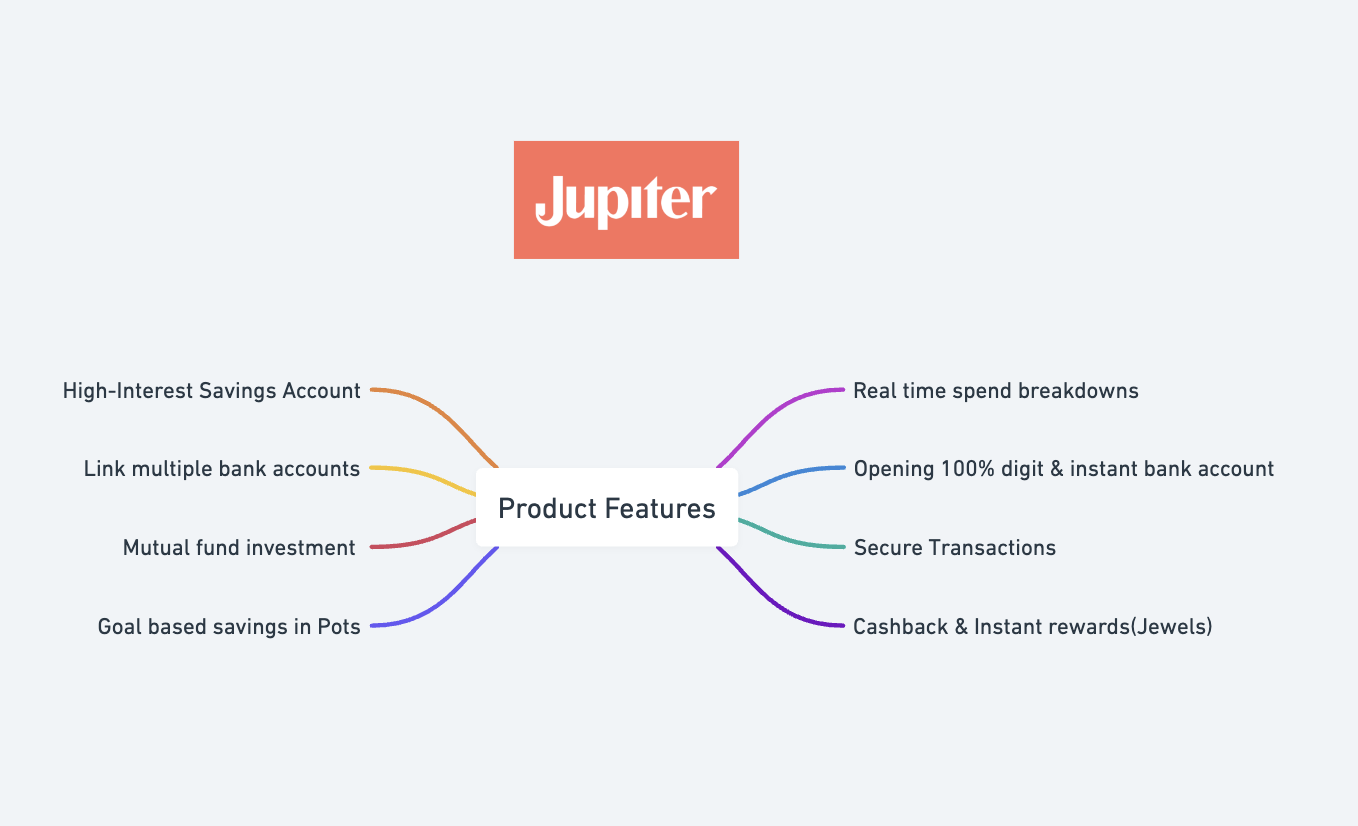

Understanding Core Value Proposition:

The core value proposition of Jupiter.money centers around providing a seamless and user-centric digital banking experience that empowers users to manage their finances effectively. Here are the key elements of this value proposition:

- Transparency: Jupiter eliminates hidden fees and offers clear, straightforward banking services

- Convenience: The platform allows users to manage their savings, track expenses, and set financial goals all in one app, providing a comprehensive solution for personal finance management.

- High Returns: With competitive interest rates on savings accounts, Jupiter helps users grow their money more effectively than traditional banking options.

- Smart Financial Tools: Features like expense tracking and goal-based savings empower users to make informed financial decisions and achieve their objectives.

- User-Friendly Experience: The intuitive design and functionality of the app make it accessible and easy to use for individuals of all financial backgrounds, especially tech-savvy millennials and Gen Z.

What are our users talking about us ?

In addition to user calls, I reviewed customer feedback on platforms like Google Play Store, Apple App Store, Reddit and Trust Pilot. This gave me a broader perspective on how users perceive the product and its performance across different touchpoints.

From user feedback we can look the following learnings :

- Users appreciate the app's intuitive design, making it easy for them to navigate and manage their finances compared to various traditional banks.

- They can track spendings from different banks at one place.

- Great rewards and cashback using Rupay Credit card for Jupiter UPI transactions.

- Some users have found that the app lacks a wider range of investment products compared to other platforms.

Understanding our ICP

This is to understand the behaviour & characteristics of ideal customers of Jupiter Money, why they decide to sign up and what values them most. By understanding this we can define our acquisition strategies.

ICP 1 | ICP 2 | |

|---|---|---|

Name | Navdeep | Yash |

Age | 34 | 27 |

Gender | Male | Male |

Marital Status | Married | Unmarried |

Location | Gurgaon | Mumbai |

Occupation | Entrepreneur | Working Professional |

Income Bracket | 50+ LPA | 20-30 LPA |

Pain points | Different bank account so spent tracking is very difficult | Dont have time to visit traditional bank |

Solution | Track all spendings at one place with enhanced features for user needs | Jupiter provides transparency , convenience and exciting rewards |

Where do you spend online ? | investments , travel, health check ups, medicine , food and drinks, shopping | Food & Drinks, Shopping, Travelling, subscriptions , gym membership |

Mode of method you use most? | UPI, Credit Card | Debit Card , UPI |

What you value most when using Jupiter? | Tracking all expenses at one place, link employee salary account to Jupiter | Instant account opening, Video KYC, Rewards |

Did you sign up first time you came across it ? | No | Yes |

What made you signup ? | Word of mouth from a friend | Promotional offer |

What is the one thing you absolutely love about Jupiter? | Portfolio analyser | User friendly interface |

What do you hate about it? | Limited investment options | Complex reward system |

Do you use any competitors? | Gpay, Fi | CRED, Gpay, Slice |

Understanding the Market

Jupiter operates in the neobanking segment of the fintech market, focusing on digital banking solutions tailored for tech-savvy consumers. This market is characterized by its emphasis on user-friendly interfaces, transparency, and a range of financial management tools, all delivered through mobile apps.

Lets look at in-depth competitor analysis-

Niyo | Fi | |

|---|---|---|

What is the core problem being solved by them? | Simplifies banking and travel expenses for users. | Helps users manage finances and savings efficiently. |

What are the products/features/services being offered? | Digital savings accounts, travel cards, wealth management. | Digital banking app, savings accounts, budgeting tools. |

Who are the users? | Tech-savvy individuals, travelers, young professionals. | Young professionals and millennials focused on financial health. |

GTM Strategy | Emphasizes ease of use, international features, and travel perks. | Focuses on budgeting, financial insights, and user engagement. |

Pricing Model | No monthly fees for accounts; earns through transaction fees. | No fees for basic services; monetizes through value-added services. |

Brand Positioning | Positioned as a travel-friendly banking solution. | Positioned as a smart banking app for financial wellness. |

UX Evaluation | User-friendly app with focus on travel and savings. | Clean interface with intuitive navigation and budgeting tools. |

Learnings | Importance of integrating lifestyle needs (like travel). | Value of user experience and smart financial tools. |

🌍A Top-Down approach to market sizing

Criteria | Share | Count | Reasoning | Source |

|---|---|---|---|---|

Total Population | 100% | ~ 1,440,000,000 | Represents India's total population, a starting point for market size estimation | https://www.worldometers.info/world-population/india-population/#:~:text=The%20current%20population%20of%20India,latest%20United%20Nations%20data1. |

Internet Penetration | 52.4% | ~754,560,000 | Percentage of population having internet connection (necessary for digital banking) | |

Number of banking customers in India | 78% | ~528,190,000 | Indians above 15 years of age who own a bank account | https://www.statista.com/statistics/942795/india-financial-institution-account-ownership-rate/#:~:text=In%202021%2C%20about%2078%20percent,less%20educated%20and%20the%20poor. |

ARPU | $30 | ~2500-3000 | Depend on frequency of transaction and type of value added service. | https://www.mckinsey.com/featured-insights/india/indian-banks-building-resilient-leadership |

Total Addressable Market (TAM): This is the total revenue opportunity available if Jupiter Money captured 100% of the market. It would be based on

-> The total number of banking customers in India.

-> Average revenue per user (ARPU) for banking services.

TAM = No of banking clients * ARPU

= 528,190,000* $ 30

= $15,845,700,000 ~ $15.8 billion

Serviceable Addressable Market (SAM): This represent the portion of TAM which can be addressable based on different product features and services. Given that Jupiter money is targeting tech-savvy urban millennials and Gen Z users who prefer convenience and personal insights , we will assume 20% Metro + Tier 1 users are addressable based on Jupiter's business model

SAM = TAM * % of serviceable market

= $15,845,700,000 * 20%

= $3,169,140,000 ~ $3.1 billion

Serviceable Obtainable Market (SOM): This is portion of SAM that Jupiter can realistically capture. Given the strong competition in market from different kinds of banks and market penetration strategies, we will assume that Jupiter can obtain 15% of the market .

SOM = SAM * % of obtainable market

= $3,169,140,000 * 15%

= $ 475,371,000 ~ $475 million

🕹Acquisition Strategy

Jupiter is in early scaling phase because it has achieved PMF, evidenced by a growing user base and positive customer feedback on its digital banking services. It is trying to enhance its product offerings (e.g., budgeting tools, investment options), improve user experience and rapidly expand the user base which is a key characteristic of the early scaling phase.

Channel Selection

Channel Name | Cost | Flexibility | Effort | Lead Time( Speed) | Scale |

|---|---|---|---|---|---|

Organic | Low | Medium | Medium | Low | Medium |

Paid Ads ✅ | High | High | Medium | High | High |

Referral Program ✅ | Medium | High | Medium | Medium | High |

Product Integration ✅ | Medium | Low | High | Medium | High |

Content Loops | Low | Medium | High | Low | Medium |

We will be focusing on 3 key acquisition channels : Referral Program, Paid Ads and Product Integration for enhancing user base of Jupiter.

Paid ads are an effective acquisition strategy for Jupiter Money because they enable targeted outreach to specific demographics, ensuring the brand reaches potential users who are most likely to engage. With immediate visibility, measurable results, and scalable campaigns, paid advertising can quickly boost brand awareness and user acquisition.

📊 LTV: CAC Framework

Metric | Description | Jupiter ( Hypothetical) |

|---|---|---|

CAC | Customer Acquisition Cost | ₹300 |

ARPU | Average revenue per user/month | ₹500 |

Margin | Gross Margin | 20% |

Retention | Customer Lifetime( months) | 12 |

LTV | Lifetime Value = ARPU*Margin* Retention) | ₹1200 |

CAC: LTV | CAL to LTV ratio | 1:4 |

Note : Considering CAC: LTV > 3, so we can proceed with paid channels of acquisition

Channel Selection Framework

Paid Advertising Channel | Effort | Cost | Flexibility | Lead Time | Scale | Budget Allocation |

|---|---|---|---|---|---|---|

Google Search Ads ✅ | Medium | High | High | Low | High | 30% |

Google You tube Ads | High | Medium | High | Medium | High | 0% |

Facebook Ads ✅ | Medium | Medium | High | Low | High | 30% |

Instagram Ads ✅ | Medium | Low | High | Low | High | 40% |

Amazon Ads | High | High | Medium | Medium | Medium | 0% |

Base on channel selection framework above, we will focus on google search ads, Facebook ads and Instagram.

Google Search Ads (30% of budget):

- Audience Selection : 18 to 35 age bracket | Tier 1 + Metro | Users looking for accessible banking options and financial management tools | ( ICP2)

- Campaign Objective: Capture high-intent traffic through search queries related to digital banking, instant bank account opening , neobank in India etc.

- Ad Type : Text Ad (for Google Search)

- Budget: Assuming a total ad budget of ₹100,000, Google Search Ads would get ₹30,000.

- Ad Specifics

- Headlines:

- Headline 1: "Hassle-Free Banking with Jupiter Money!"

- Headline 2: "Sign Up Now for Instant Access!"

- Headline 3: "Earn Rewards with Every Transaction!"

- Description : "Experience seamless banking with instant transfers and real-time spending insights. Join Jupiter Money now for cashback offers and personalized financial management!"

- Sitelink Extensions:

- "Features" – Direct users to a page detailing app features.

- "Rewards Program" – Link to the rewards section.

- Callout Extensions:

- "Instant Account Setup"

- "Secure Banking"

- "Cashback Offers"

Facebook Ads (30% of budget):

- Audience Selection : Target both ICP1 and ICP2 for more impressions and CTA.

- Campaign Objective: Drive installations of the Jupiter Money app and encourage sign-ups for new accounts, focusing on conversion rates.

- Ad Type : Carousel Ad

- Budget: Assuming a total ad budget of ₹100,000, Facebook Ads would get ₹30,000.

- Ad Specifics

- Image/Video 1:

- Content: Visual of the app's interface showcasing "Instant Account Setup."

- Text Overlay: "Open Your Account in Minutes!"

- Image/Video 2:

- Content: Graphic highlighting "Cashback Rewards."

- Text Overlay: "Earn exciting cashbacks, discounts and rewards!"

- Image/Video 3:

- Content: Visual of expense tracking features.

- Text Overlay: "Manage Your Expenses Effortlessly!"

- Image/Video 4:

- Content: Highlighting budgeting tools.

- Text Overlay: "Stay on Top of Your Budget!"

- Image/Video 1:

- Targeting: Utilize Facebook's detailed targeting to reach both Millennials and Gen Z based on various interests and behaviors buckets.

Instagram Ads (40% of budget)

- Audience Selection : Focus on primarily targeting ICP2 to establish Jupiter as their go-to app for all financial needs.

- Campaign Objective: Highlight special offers, referral bonuses, or cashback programs to incentivize users to take immediate action.

- Ad Type : Stories Ad

- Budget: Assuming a total ad budget of ₹100,000, Facebook Ads would get ₹40,000.

- Ad Copy: "Banking made simple! Open your Jupiter Money account in minutes and enjoy cashback on every transaction. 💰✨ #JupiterMoney"

- Ad Specifics

- Reels Ad : Use engaging, short video clips or images to showcase app features like budgeting tools and expense tracking.

- Influencer Collaboration : Partner with popular Millennial finance influencers for wider reach and credibility. Collaborate on exclusive promo codes or referral links for their followers to incentivize downloads and sign-ups.

Jupiter can leverage product integration as a key acquisition channel. By facilitating seamless transactions across various platforms, it can enhance the overall user experience, leading to higher engagement and retention, as customers favor all-in-one solutions. Strategic partnerships will boost visibility and attract new users, while insights gained from these integrations will allow for more effective, targeted marketing strategies.

⭐ Product Integration Framework

Product your ICP most interacts with | Frequency of these interactions | Importance of these interactions | Can your product add value to these interactions | Potential to get customers/ new use cases |

|---|---|---|---|---|

BookmyShow | Medium | Somewhat | Somewhat | Low |

Zepto ✅ | High | Very | Yes | Medium |

Make My Trip | Low | Very | Yes | Low |

Google maps | High | Not important | Unsure | High |

Myntra | Medium | Somewhat | Somewhat | Medium |

Integrating Jupiter Money inside Zepto can enhance the user experience and drive growth for both platforms, based on Product Integration framework prioritisation.

Situation : Shubhi was cooking dinner and realised she is out of some key ingredients . She quickly opens her Zepto app and add items to her cart. During checkout she used either Jupiter UPI or Jupiter credit card for payment and earned exciting rewards on her purchase. Here's how integration works for them.

User Journey for Shubhi :

🎁 Referral

Current Referral System

Jupiter's referral program encourages existing users to invite new customers by offering attractive rewards in the form of cashbacks and discounts. Her are some key features of the program:

- Incentives: For each successful referral, the referring user receives ₹1000, while the new user earns ₹500 upon completing their first payment.

- Ease of Sharing: The program is user-friendly, allowing participants to share a unique referral link effortlessly via WhatsApp and other platforms using a simple referral code.

- Limited Availability: The referral code is available for only 14 days, creating a sense of urgency and highlighting the exclusive benefits of joining Jupiter.

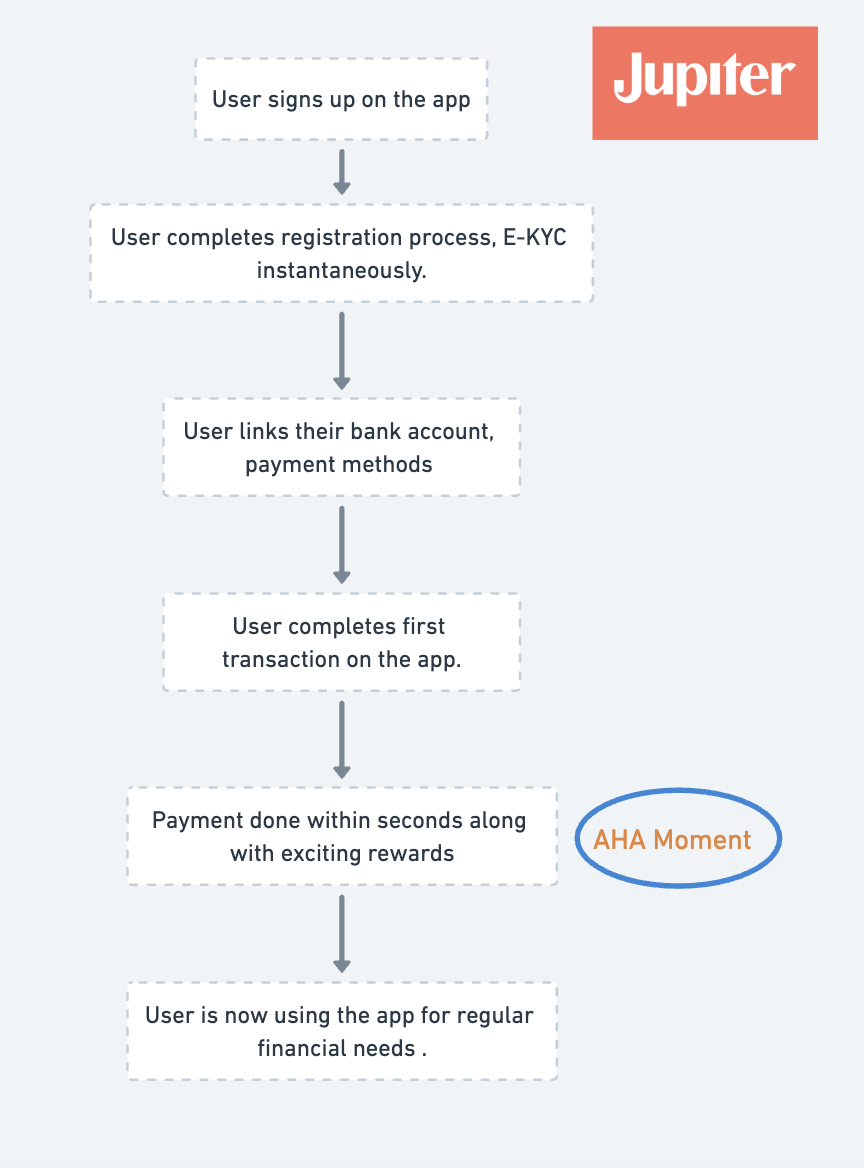

When will users experience their "AHA moment" while using the Jupiter app?

- Instant Account Setup and Access:

- Users experience a significant "AHA moment" when they realize they can open a new bank account in just a few minutes and gain immediate access to their account features, including an instant virtual debit card.

- Immediate Rewards upon First Transaction:

- After completing their first transaction, users often have an "AHA moment" when they receive instant cashback or rewards. The realization that their financial activities can lead to immediate benefits reinforces the value of using the app, making them feel appreciated and encouraging them to engage further with Jupiter’s offerings.

What is the platform currency ?

Rewards as Jewels -

- Transactions: Users earn jewels for completing various transactions, such as making payments, transferring money, or achieving savings goals.

- Engagement Activities: Additional jewels can be earned through specific activities, such as referring friends or participating in challenges within the app.

New Referral Design

Who do you ask for a referral ?

Engage customers who have recently experienced Jupiter's seamless banking experience and are satisfied with their instant account setups/ KYC/ approvals etc. Introduce the referral program on the profile section after first successful transaction, capitalizing on their positive experience and current engagement with the app.

How will they keep referring ?

For this, we will look at users who have successfully referred 1+ user. We will create a stagging reward for next referrals and create a milestone reward for 10+ referrals .

Phase 1: Kickstarting the Referral Journey

- Milestone 1: Refer 1 friend, and get ₹1000 in your account.

- Milestone 2: Refer 5 friends, and earn ₹7000 in your account.

- Milestone 3: Refer 7 friends, and receive a whopping ₹10,000 off in your account.

Phase 2: Exclusive 2D1N stay at Taj Hotel for a couple, only for users who have successfully referred 10 friends.

New Referral flow

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.